FH Brussels at the IAA2017: a politically charged edition

Last Monday 25 September, only two statistics mattered in Germany, an attendee at the International Motor Show (IAA) 2017 in Frankfurt told me: the outcome of the federal elections, which resulted in a substantial loss for the incumbent government, and the number of IAA visitors. The former may well bring Germany’s Greens into the government’s fold, a party that has pledged to ban combustion engines by 2030. The latter, if declining, would give a tacit signal that the influence and appeal of the country’s mighty automotive industry is waning. It goes without saying that these are interesting times for Germany’s prodigious car industry.

“No previous IAA has ever been more politically charged”

Automobilewoche

This year’s IAA, Germany’s largest and most popular trade fair, that FleishmanHillard Brussels attended two weeks ago was perhaps the most politically charged edition in living memory, German newspaper Automobilewoche noted. The image of the industry suffered a severe dent, it has made lamentable mistakes and now comes the challenge of regaining consumer confidence, acknowledged also Matthias Wissmann, VDA’s President, in a speech during the conference. Despite all this, he was surprisingly upbeat and confident about the industry’s hallmark product: “we are holding on to the internal combustion engine,” his words greeted with a resounding applause, “our engineers are on the right side of history.”

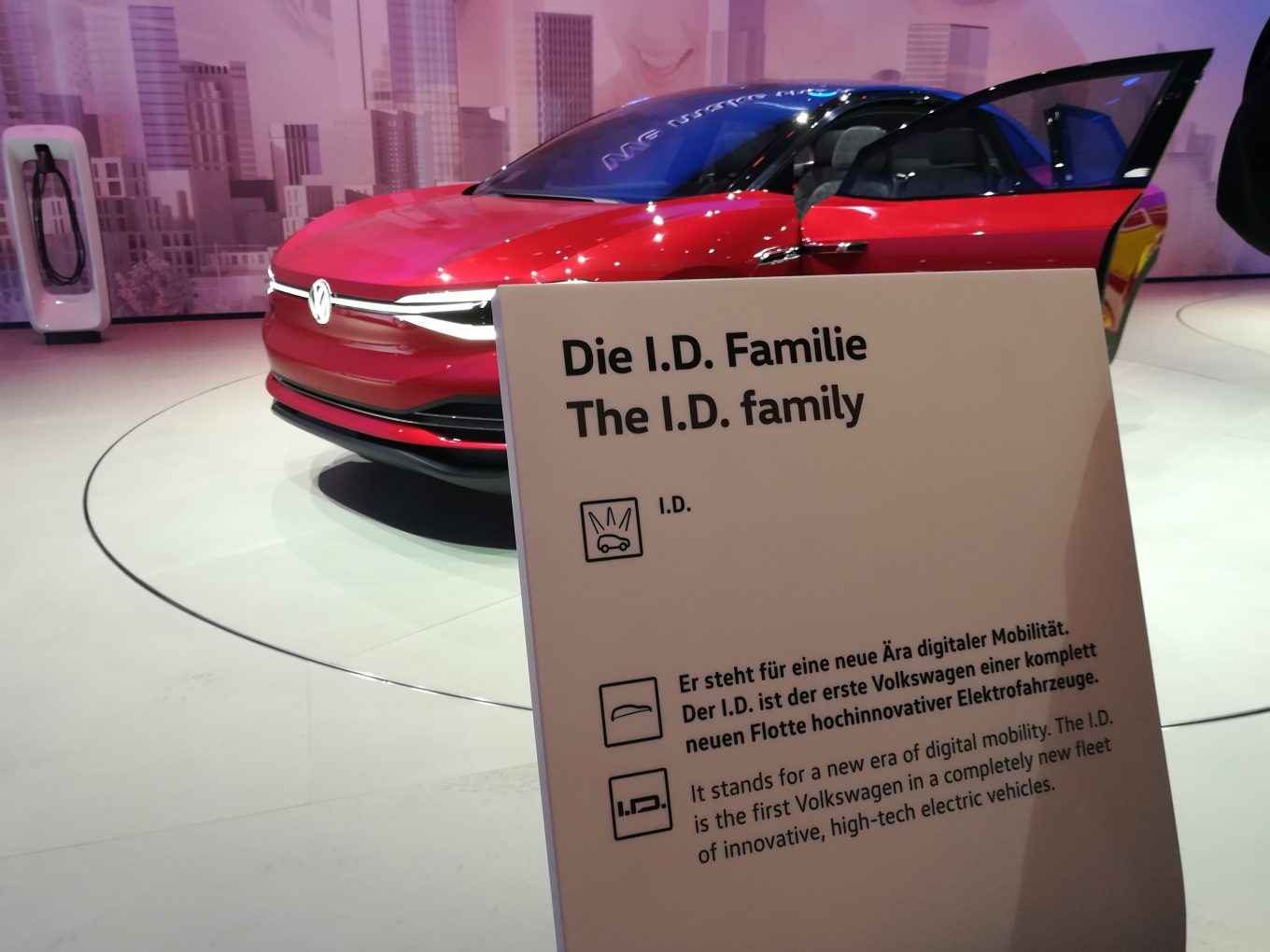

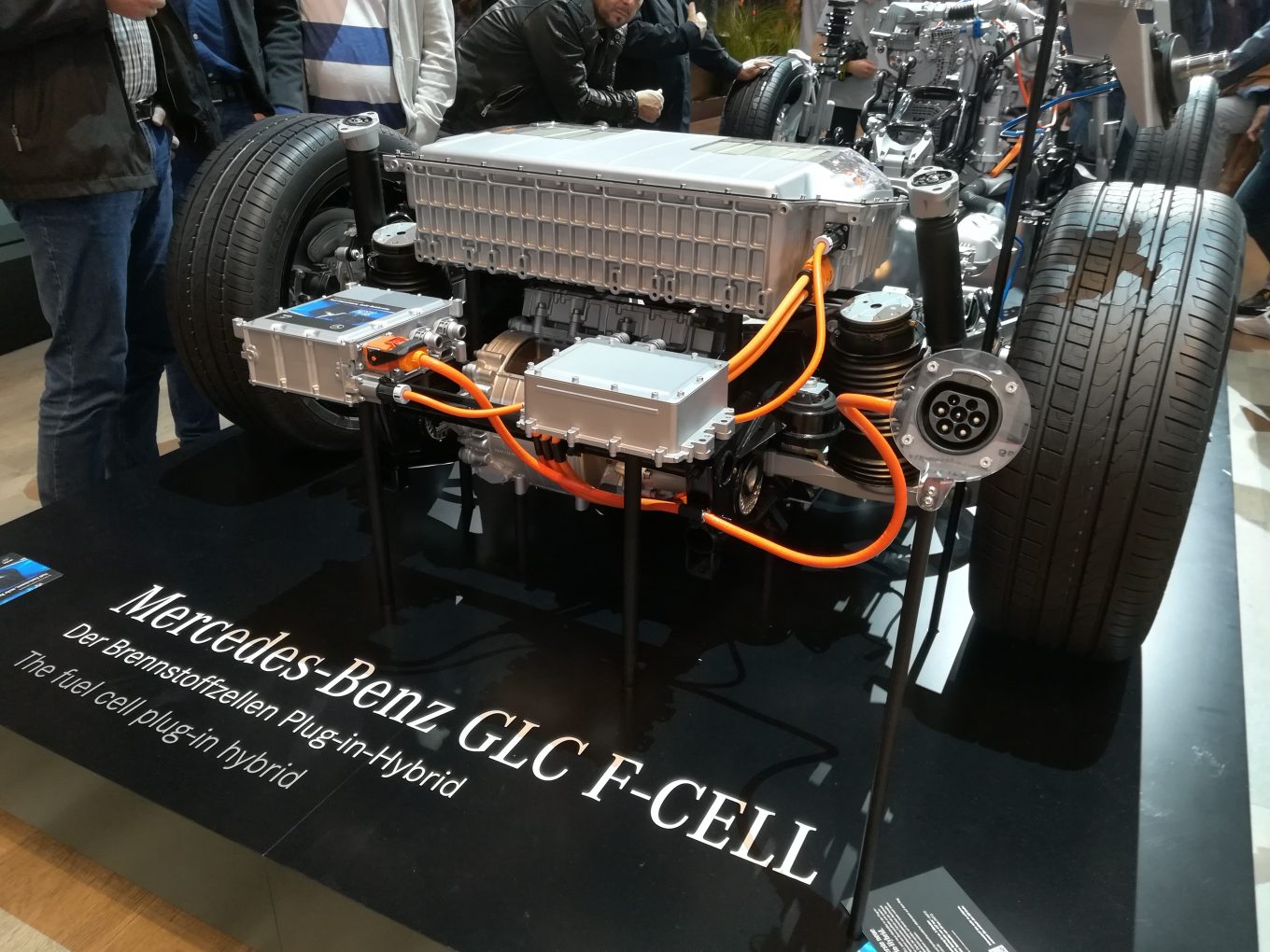

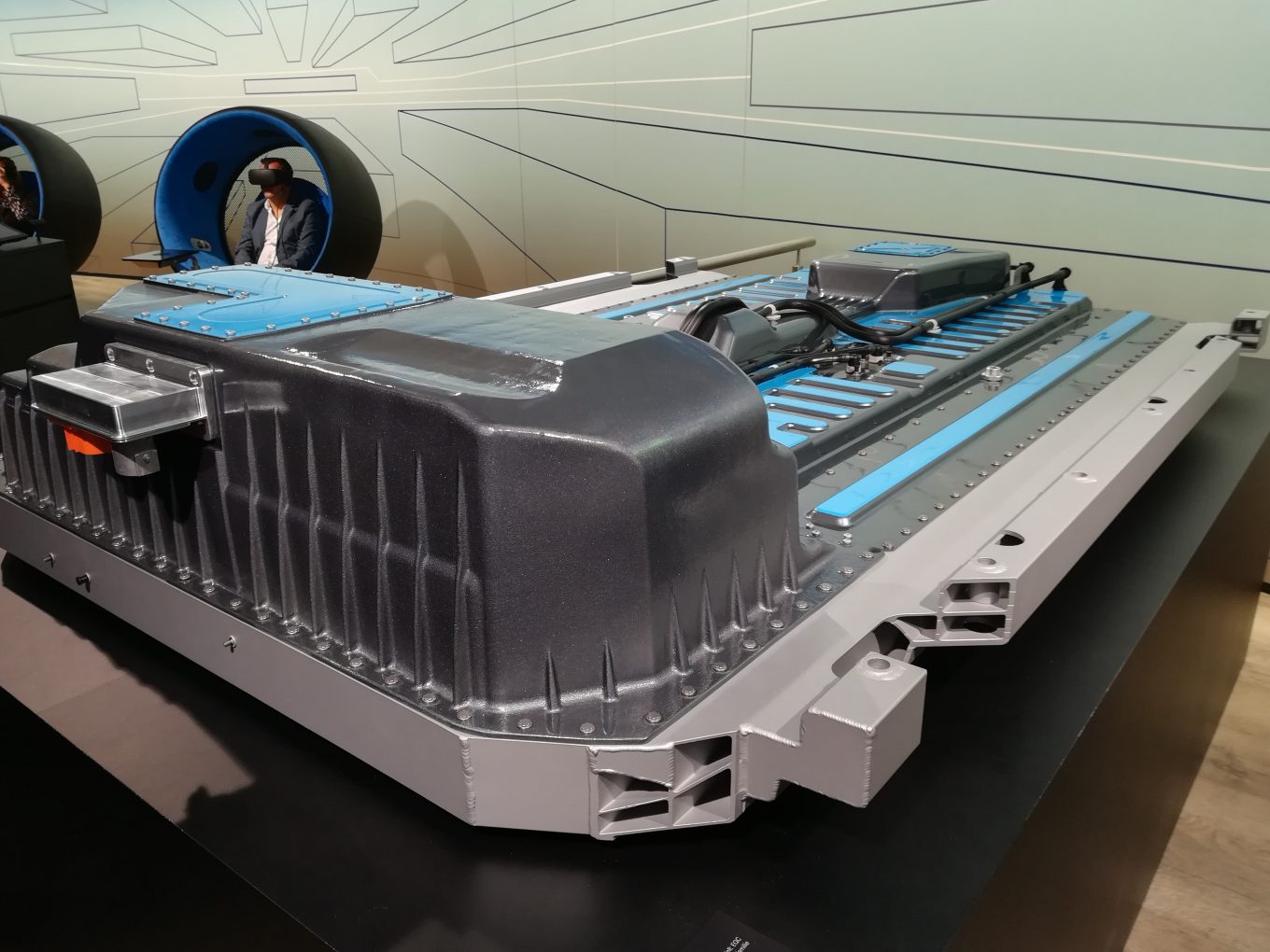

That the onus remains on conventional combustion engines was clearly reflected in the displayed models and technologies at this year’s fair: while the IAA showed the gradual emergence of plug-in hybrid vehicles at the stands of BMW, Volkswagen and Mercedes, most of the fully battery-electric vehicles on display, such as Mercedes’ EQA, are still presented as concept cars, a future vision if you will, not necessarily as a marketable consumer product. The big shift is still a couple of years out: Mercedes wants to offer around 10 models in electric edition by 2022, Volkswagen expects its entire catalogue to be available as electric only by 2030.

“e-Mobility is a marathon, not a 100 metres sprint”

Audi CEO Rupert Stadler at the IAA Symposium

Engineers told me that they expect the combustion engine to have another 10% or 20% emissions reduction potential. To further optimise its performance, the industry in parallel bets heavily on carbon-neutral fuels, such as synthetic fuels and eFuels. While those energy sources still produce tailpipe emissions, they extract the equivalent amount of CO2 from the atmosphere during their refining process. These are all promising signs that the internal combustion engine is not dead yet.

The problem is that from a regulatory perspective, CO2 emissions for cars and vans are still expressed as tank-to-wheel emissions, and thus vehicles using carbon-neutral fuels are not zero-emission in such a logic. The Commission has indicated that it will not shift away from a tank-to-wheel to a well-to-wheel approach in the upcoming post-2020 CO2 standards for cars and vans, given the regulatory complexities a singular Regulation addressing both fuel producers (the well-to-tank bracket) as well as OEMs (the tank-to-wheel bracket) would bring.

What is likely going to be a key element of that Regulation, though, is a quota or sales mandate for low- or zero-emission vehicles. While cognisant of the fact that industry does not particularly like the sound of a technology-specific target, European Commission Vice-President Maroš Šefčovič recently told Süddeutsche Zeitung that he was convinced Europe needs “a signal”. Judging from what was being showcased at the IAA2017, it may be a reality the automotive industry is not yet ready to embrace.

We’ll have to wait until November to see how a sales mandate can be designed from a regulatory point of view, especially given the fact that the Commission has no competence over so many of the incentives that have driven consumer uptake of electric vehicles over the last couple of years: free parking, the use of bus lanes, tax breaks and, last but certainly not least, the availability of the required charging infrastructure.

I owe you one last thing: the number of visitors at the IAA2017. With an estimated 810,000 visitors this year, that is lower than last time round in 2015, when over 930,000 people travelled to Frankfurt. Is that an industry in decline, or just a bump in the road? I’ll leave it up to you to judge.

ACEA Secretary-General Erik Jonnaert opening the IAA Symposium “Combustion engine – problem or part of the solution?”

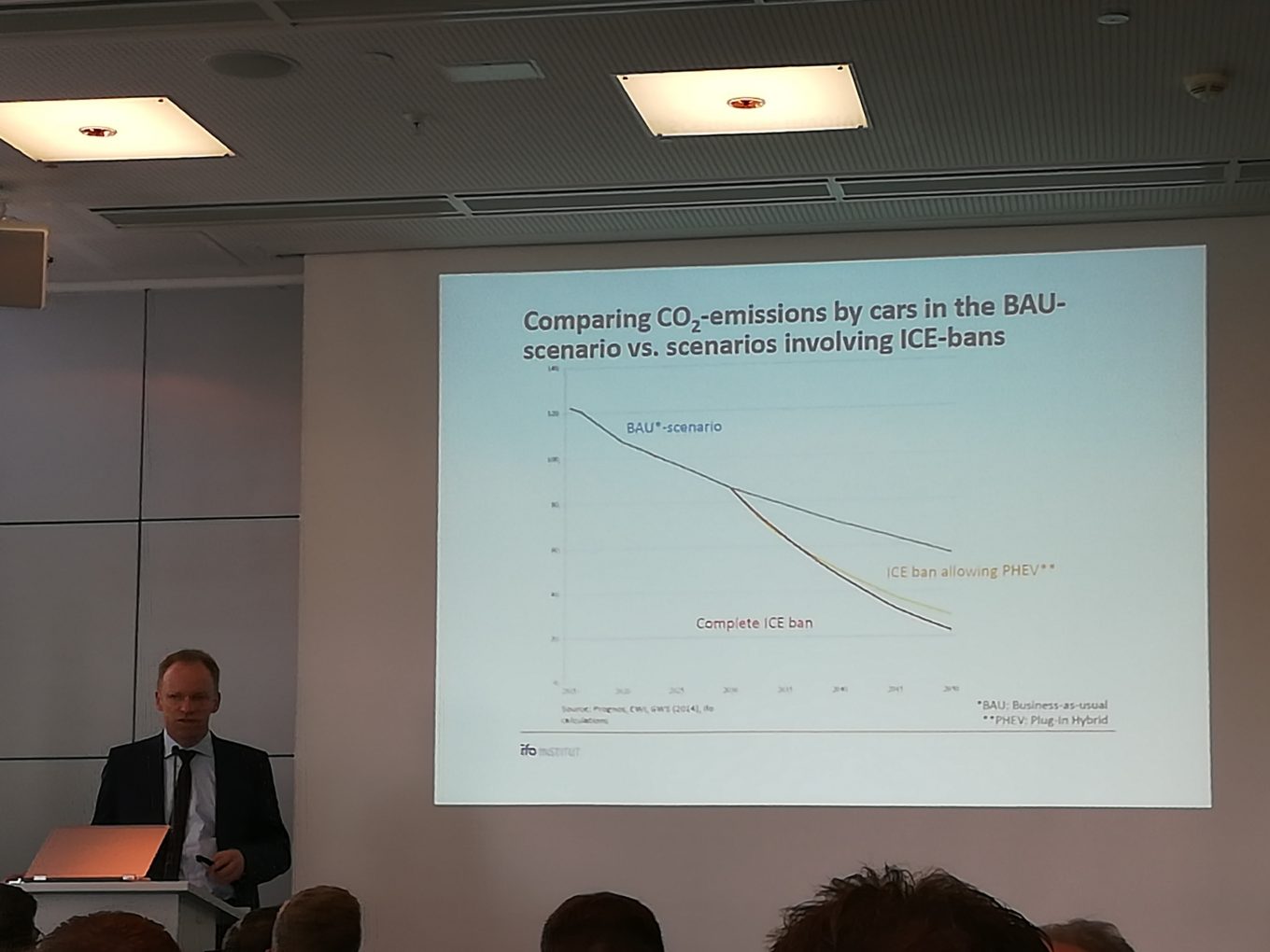

The ifo Institute for Economic Research presented a study on the impact of combustion engine bans on employment and value added in German manufacturing

Representatives from the Visegrad Group, including State Secretary for Economic Development of Hungary István Lepsényi shed their light on the future of the expansive automotive industry in their countries

810,000 people visited the IAA2017 this year. Less than in 2015, but it remains Germany’s largest trade fair

For now still an I.D.?

Plug-in hybrids for now seem to be the OEMs’ first major step in alternatively-fuelled vehicles

Nevertheless, full-battery electric powertrains were on display

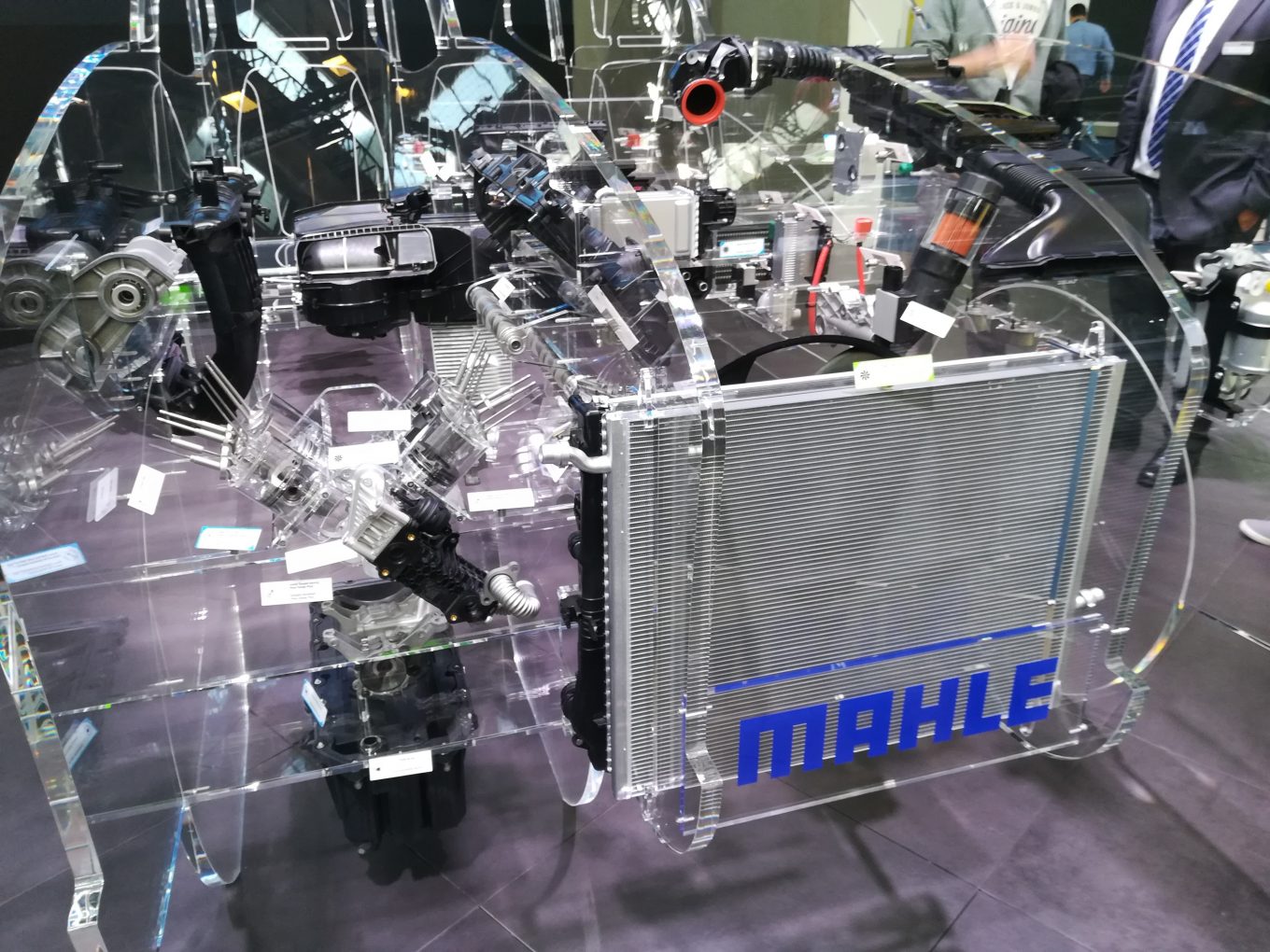

Several automotive suppliers showed the potential further optimalisation of the internal combustion engine, including MAHLE

In the wake of Dieselgate, several car manufacturers are quick to embrace new technologies

-

Thomas joined the FleishmanHillard Energy & Transport team in early 2017, with a primary focus on the aviation, automotive and logistics sectors. He advises his clients on stakeholder engagement and legislative advocacy and supports them in creating durable relationships with policymakers. Before joining FleishmanHillard, Thomas...

Find Out More

-

Are you fit for 2024? Communicating in a year of change

February 27, 2024