After several years of intense debates, the European Commission recently released its legislative overhaul of the EU digital rulebook. This includes the two flagship initiatives on content moderation and competition in the digital economy. The Digital Markets Act (DMA) and Digital Services Act (DSA) will have far-reaching consequences on digital markets and online platforms. The question remains how far.

The EU’s approach includes some of the most stringent legislative changes ever seen since the adoption of the E-Commerce directive. These potentially include banning some behaviors or imposing structural unbundling on platforms. In doing so, the EU is once again claiming its role as the legislative laboratory of the digital space. Both files are meant to create a fair and safer online environment, as well as to enable European ventures to scale up. And the EU wants to lead in setting international standards to ultimately strengthen its ability to compete in a global and increasingly digital economy.

But there is still a long way to go. Negotiations on both files will be revolving around thorny issues such as the scope and definitions, obligations and exemptions, as well as the supervisory and enforcement mechanisms at play. Expect at least two years of heated discussions in a politically fragmented Parliament. New groups of stakeholders such as in financial markets, and the tensions within senior levels of the Commission alongside the apparent lack of cohesion and unity in the Council will also shape the outcomes on both files. Growing divisions are emerging between governments having a more adversarial stance against the Big Tech players and those opposing too prescriptive Internet regulations.

Below are some of the key drivers that have already began to shape this debate.

Franco-German Engine – French and German domestic legislation on platforms and competition is directly influencing the debate at European level. As recent negotiations on digital files have shown, serious policy derailment can occur if the two member states are not in sync.

National Elections – the pressure on social media platforms to moderate content and counter disinformation ahead of key elections will only continue to grow.

Geopolitics – regulatory convergence is questioned, with the UK already laying out plans to reform its competition tools and the uncertainty regarding the new US administration’s positioning on tech policy, as well as vis-à-vis China. All these are likely to comfort Europe’s ambitions for strategic autonomy and the development a global soft-power toolkit to defend EU interests.

Social Justice – Civil society and consumer organisations will continue to demand more accountability and transparency from digital players. Industry will likely seek to protect unwanted stifling of innovation that would hinder Europe’s attempts to be competitive.

COVID-19 crisis – seen as an accelerator of digitalization. Decisions will be driven also by the perceived ‘winners vs losers’ debate, and who will be contributing an extra effort to European recovery.

Other key policy streams – as more voices call to tackle market concentration in both B2C and B2B markets. Discussions around data access and the role of data intermediaries in the Data Governance Act will also play a role, just as will parallel discussions on state aid, trade and taxation.

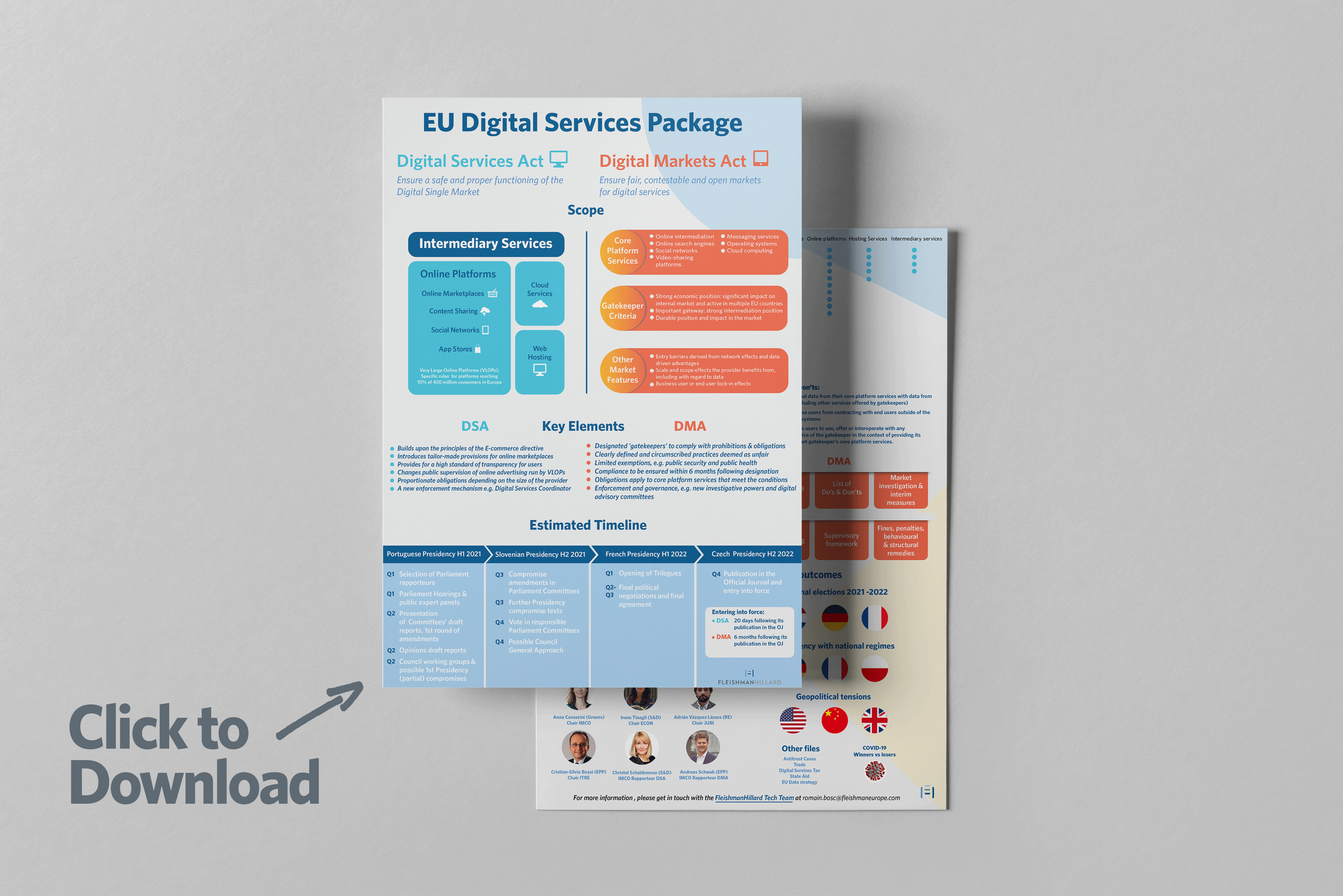

If you are interested in learning more about this topic, feel free to download our latest infographic which includes an overview on the main issues and our suggested timeline.

Find Out More

-

Generative AI is changing the search game

May 8, 2025

-

The challenges facing Europe and European leaders at Davos 2025

January 24, 2025