In the run up the UK elections FleishmanHillard reached out to its network of clients across the EU to ask them what they thought of the possibility of a ‘Brexit’ . The feedback was overwhelming in its clarity – business is concerned that a Brexit would not just hurt Britain, it would hurt Europe. Below are some key quotes with which to contextualise business, Britain and Brexit.

“We are concerned about the uncertainty caused by the Referendum”

The UK is important to many of our clients, and not just as a market. One client remarked that the UK was the home of an R&D centre, for which the free movement offered by the EU was vital. The benefits of the UK’s position as an English-speaking country which enjoys a generally positive business environment make it a key investment point and ‘staging ground’ for many international businesses. Businesses from outside the EU invest in the UK disproportionately to its share of Europe’s economy: in 2013 the UK commanded 20% of FDI, while producing about 15% of GDP.

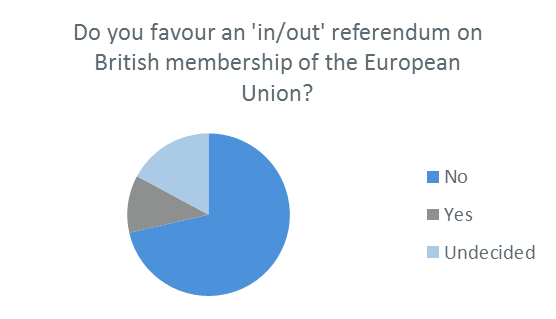

It’s clear that businesses are happy to invest in the UK. What is also clear is that businesses are nervous about a Brexit; a recent survey of business leaders highlighted that it is even more concerning than a ‘Grexit’ (Greece’s possible departure from the Eurozone). It seems likely – and prudent – that businesses will be more hesitant about investing, when the stakes of the upcoming referendum are so high. It is for this reason that the new UK government seems to be considering a referendum in advance of its already ambitious 2017 deadline. Minimising the period of uncertainty is doubtless a step in the right direction, but it seems businesses would rather not see the issue come to a head, only 11% of respondents to our survey favoured having a referendum at all.

“Regulation and market barriers as a consequence of a Brexit would substantially harm our business”

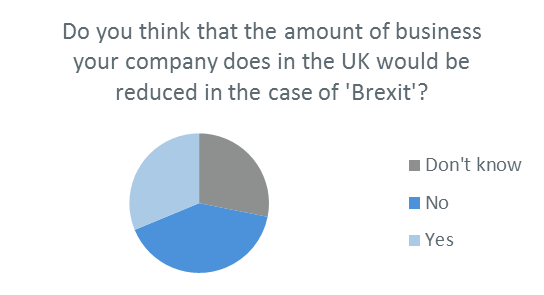

There are those who fear that regulation and market barriers will negatively impact their business. The altered future relationship between the UK and the EU could mean that where once the “free movement for our supply chain across borders and for our workers is valuable” the reinstatement of barriers, wholly or partial could serve to make trading with the UK more difficult. When we asked our clients whether they think a Brexit would see them reducing the work they do in the UK, they were split quite evenly. Britain is the EU’s second biggest economy, and businesses are unlikely to stop trading with it, regardless of its membership status. What will happen though, as cited by our clients, is that the UK will no longer be an agenda setter, with limited ability to steer the course of the EU’s economy. However, while the recognised advantages of the EU Single Market would prove a difficult obstacle if revoked, one client envisaged that the “most important bottom line element for our UK business is the UK business environment, notably tax levels and this is independent from the work of the EU.” This correctly identifies one of the most popular aspects of investing in the UK, and while the tax levels would evidently not be affected by a Brexit of any kind, the business environment rests on tender hooks as uncertainty over the future prevails.

“Brexit would simply be another factor to the broad view that Europe is less and less attractive for investments”

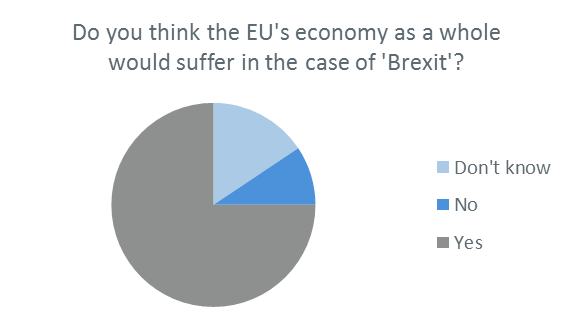

One highly pessimistic view depicts a Brexit as the final straw in a long history of decisions which contribute to an uncompetitive and stagnant investment environment – something the European Commission seems well aware of, considering the grand efforts of the Juncker Plan (an investment fund for Europe championed by Commission President Jean-Claude Juncker) to stimulate growth and investment in the EU. Our clients certainly think that this would be a step backwards for the EU as a whole, with an overwhelming majority agreeing that the EU’s economy would suffer in the case of a Brexit. Perhaps the view of many in the US when it comes to the EU was summed up by US Presidential long-shot Bobby Jindal when he said they must avoid turning “the American Dream into the European Nightmare.

“It would be a glorious mistake”

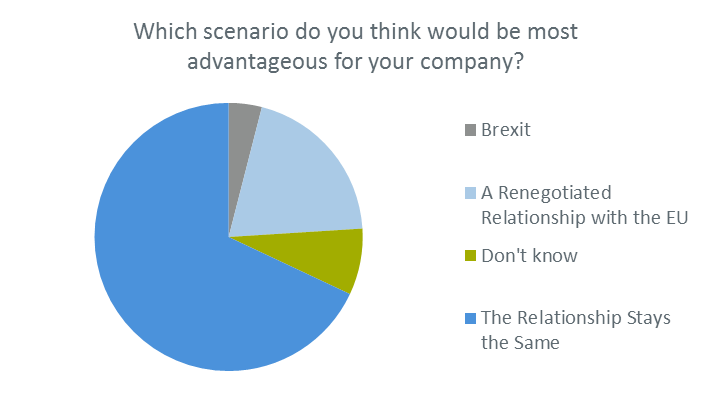

At present, nobody knows what the terms of a Brexit would be, or even what is being requested in the “renegotiation” period leading up to a popular vote. There are a number of overhanging issues, for example Directives which are transposed into national law would still apply if the UK were to leave the EU, agreements which have been signed with countries the world over on trade and international relations will have to be renegotiated. That is not to say that the UK’s relationship with the EU must stay the same, businesses are certainly open to the possibility of negotiation, but Brexit is overwhelmingly considered a bad idea. Therefore the above short comment which neatly summarised what a lot of our respondents were conveying may become true, however it remains to be seen how a Brexit might work, what basis a future relationship with the EU would be served on and the state of the UK post-EU.

Rob Anger, Martin Bresson, Joachim Wilcke, Cillian Totterdell and Anne Murray

4 Comments

Find Out More

-

Generative AI is changing the search game

May 8, 2025

-

The challenges facing Europe and European leaders at Davos 2025

January 24, 2025

July 22, 2015 | 11:41 PM

Thank you! Your comment is awaiting moderation.

[…] 4: Very few UK companies think Brexit would be a good idea (Source: Public affairs 2.0), so why is it on the […]

May 21, 2015 | 4:48 PM

RT @fleishmanEU: ‘Brexit’ – What does industry think? Armageddon or Valhalla? http://t.co/dvqt9Deu3h @BritchamBxl #ge2015 #Brexit

May 21, 2015 | 3:58 PM

‘Brexit’ and Business – What does industry think?: http://t.co/K9I4pWF7rc

May 21, 2015 | 11:05 AM

RT @fleishmanEU: ‘Brexit’ – What does industry think? Armageddon or Valhalla? http://t.co/dvqt9Deu3h @BritchamBxl #ge2015 #Brexit