Juncker’s strategy could kick start some badly needed investment in Europe’s energy infrastructure

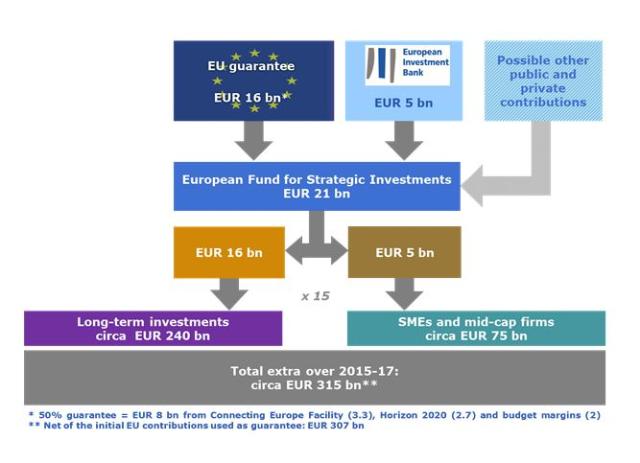

On Wednesday Commission President Juncker announced his long-awaited investment strategy, a plan which aims to give Europe’s economy a much needed shot in the arm as the bloc continues to stagnate. Formally called the European Fund for Strategic Investments (EFSI), the mechanisms of the fund are based on leveraging an initial €21bn into an eventual €315bn of investments in both long term infrastructure and short term access to capital for SMEs and mid-cap firms.

The strategy itself is based on three main principles (the “three sides of the triangle”, as Vice-president Katainen put it at the Strategy’s launch).

- New finance will be mobilised

- Finance will be steered towards EU approved projects

- Regulatory barriers will be removed via the entrenchment of the single market.

With enough leverage…

The basic principal behind the fund is quite simple (though no doubt the economics will be discussed ad nauseum in the coming months).The fund is intended to act as a first line of investment, shouldering risks which traditional banks might shy away from, and in doing so, it hopes to encourage private investors to fall in line behind it. “At the heart of this package there is a political choice” Vice President Katainen explained during his speech. The EU must choose between a traditional grants and loans system, limited by the capital at hand, or it can facilitate “riskier borrowing and create a larger lending capacity”.

Diagram 1: How the strategy should work

Energising Europe’s future

The second part of this “triangle” is the identification of infrastructure projects for funding. The EU is currently reviewing around 1,000 projects for viability and utility, and those that receive the “European stamp” can expect to have the weight of this fund behind them, reducing the risk and incentivising investors

It comes as no surprise, given the current cloud hanging over Europe’s somewhat precarious energy situation, that a good chunk of this fund will be earmarked for investment in energy infrastructure. Vice-president Šefčovič may not have been presenting the plan, but he certainly will have a hand in running it, with the oft-repeated goals of “completing the internal energy market” and “diversifying supply” firmly on his mind.

The abovementioned projects will no doubt have drawn heavily on the ‘Projects of Common Interest’ (PCIs) agreed last year, boosting financing and speeding up infrastructure development. However, Katainen shied away from making any firm commitments, saying “there will be no sector-specific or country specific quotas”. This leaves an air of uncertainty over how much of the fund will be spent on energy, though there is no doubt in its priority

Tearing down the barricades

The third side to the triangle, the completion of single markets in the energy, digital, services and transport sectors, was spoken about at length by Katainen. It comes as no surprise that energy infrastructure was a top priority, given its necessity in the completion of the energy union. “There are many people who want to invest in the energy sector” he noted “but until we have an Energy Union they cannot do so as easily as say in the food sector”.

Picking Winners

The trouble with an investment fund, it appears, is that it will have to choose what to invest in. This immediately leaves the Commission open to the often heard criticism that it is interfering in the market and inevitably “picking winners”. Immediately after the strategy was proposed numerous industry associations published position pieces that were at the same time optimistic and concerned. Aside from those that were sceptical (to put it lightly) of the level of private investment the fund would create, renewables industries were quick to claim this as a large step forward for their sector, while the more ingrained electricity providers were more cautious, encouraging investment in the “framework”, while leaving technology choices up to the market

What happens now

Juncker has bet on the fund sailing through the other institutions. Certainly, Parliament President Schulz appeared to welcome it with open arms, calling it a “turning point” following years of financial and currency woe and austerity. However, we will have to wait until the next European Council meeting (between 18-19 of December) to see how much the Member States agree. All going according to Juncker’s plan, the fund should be up and running by spring 2015.

Cillian Totterdell and Cillian O’Donoghue

Find Out More

-

Generative AI is changing the search game

May 8, 2025

-

The challenges facing Europe and European leaders at Davos 2025

January 24, 2025